Company: Backbase | Year: 2022/23 | Platform(s): Web

Facilitating personal money management

This project aimed to enhance the existing product by revamping core legacy features related to personal finance management, also known as ‘Insights’. This involved creating a new dashboard that presents data more clearly and structured, empowering users to manage their finances more effectively. Consequently, this would help banks to retain and attract more customers.

Integrated functionality

More cohesive and integrated experience that supports future capability growth

User-centric experience

Improved experience designed to boost user satisfaction and engagement

Higher product adoption

More attractive product offering expected to increase client adoption

From different features to one experience

The team had an obvious challenge: legacy features related to each other were scattered throughout the app. The outdated nature of such features, built and designed years ago, also hindered product adoption by existing and new clients. So we knew there was ample opportunity to create a more cohesive and integrated experience for users, making it more compelling for banks to buy our product.

Uncovering insights through research

To ensure this new unified experience met both user needs and business goals, I collaborated closely with the product and research teams to gather as many actionable insights as possible. This included a mix of qualitative and quantitative research methods that informed and validated our strategy and design decisions.

Client feedback: understanding banks’ needs

The team directly engaged with six clients and their stakeholders to gather feedback on the various ‘Insights’ features. The goal was to understand their pain points and needs, which would help inform our design direction.

Benchmarking money management apps

I extensively analyzed 14 industry-leading personal money management apps to identify best practices and the most common features and functionality. Among them were Mint, CoPilot, TrueBill or N26.

Survey: how do people manage their money?

In collaboration with the UX research team, we created a survey (17 questions) to gather quantitative data from a broad user base (397 respondents). This was invaluable in understanding user behaviors and preferences related to personal money management on a larger scale.

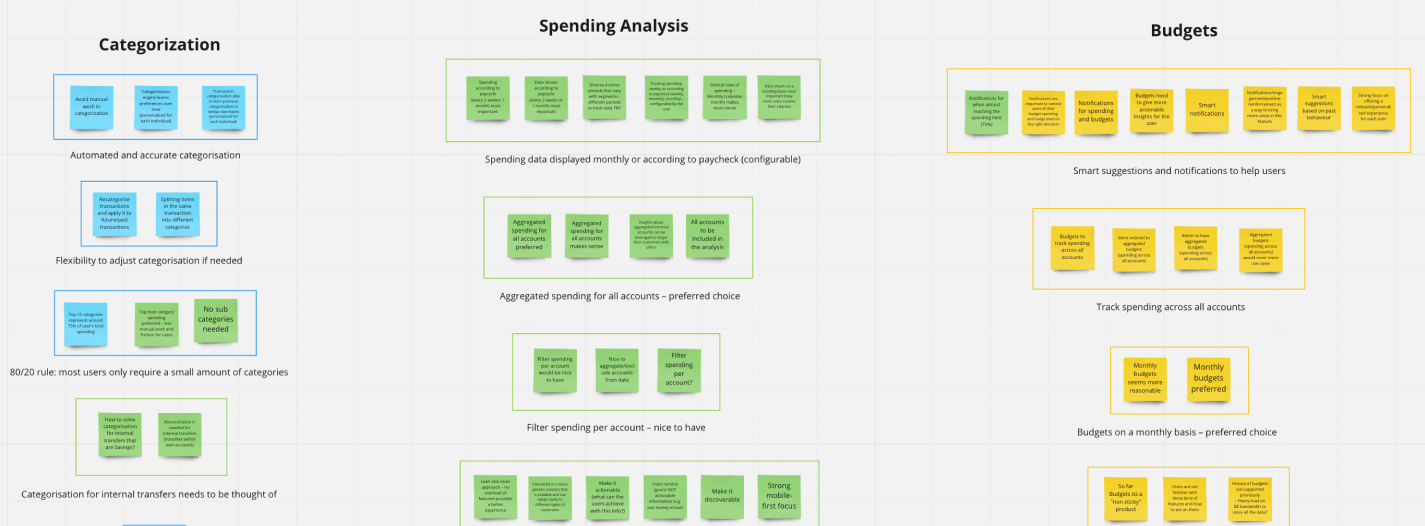

Turning research into design strategy

After an extensive research journey, it was time to translate our findings into actionable design recommendations for both short and long-term implementation. These recommendations aimed to guide the design strategy for the new experience, ensuring our solution remained user-centric and aligned with business goals.

Helping people increase their savings

Helping users increase their savings or start saving is a key goal. Empowering their financial well-being and aligning our capabilities with this “north star” will drive value and engagement.

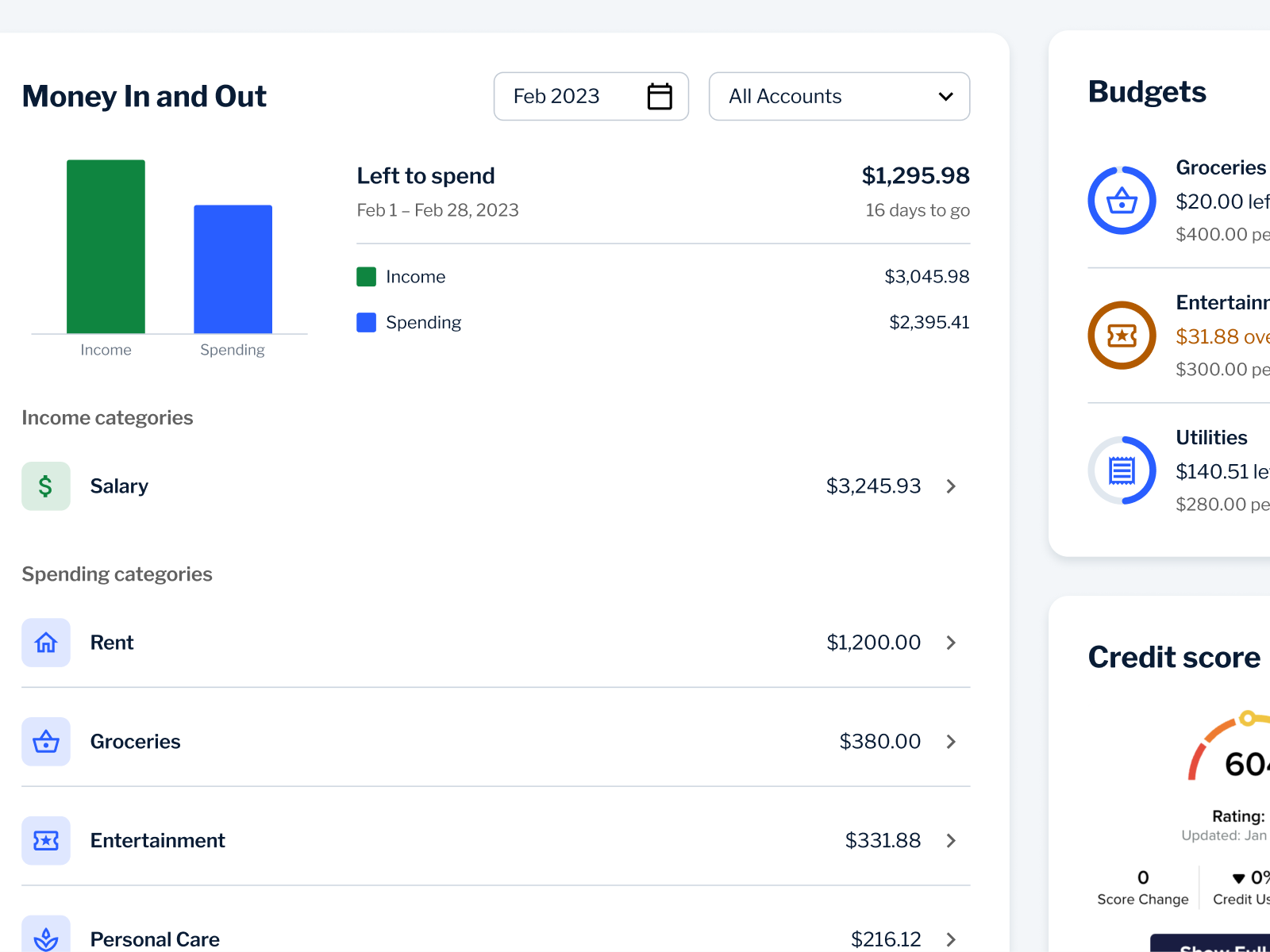

Providing a financial overview

Providing users with a simple overview of their personal finances, such as income, spending, and savings, allows them to better track their financial health and make more informed decisions.

Proactively guiding users

Delivering timely and personalized information to users is crucial. For instance, notifications about nearing certain budget limits can prevent overspending and foster better financial habits.

Allowing easy budgeting

Enabling users to create budgets, not only for specific categories (e.g. Groceries), but also for their overall consolidated spending facilitates budget management for more casual users.

Categorizing transactions accurately

It’s essential to have a strong and reliable categorization engine in the app, while still allowing for users to manually adjust transactions when necessary.

Managing recurring expenses and subscriptions

Creating a place where users can effortlessly view and manage all their recurring expenses and subscriptions, empowers them to take more control of their finances and adjust spending where necessary.

Filtering data in meaningful ways

Providing enough flexibility in how user’s financial insights are displayed, specially in terms of dates and accounts, adds value to the experience by covering a broader range of user preferences.

A new beginning for Insights

Soon after finalizing the MVP designs for the new dashboard in early 2023, the project transitioned to another development team that would work on the initial implementation and any future enhancements.

Although I had to shift focus to other priorities, I was confident that all the work done until then would contribute to bringing this capability, and our product, to the next level. With access to all the previous research and resources, the new team can continue to build and refine Insights to meet evolving clients’ needs and user preferences, setting a strong foundation for future innovation across our product portfolio.